Quick Summary

A financial health check is a proactive review of key metrics to spot trouble before it becomes a crisis.

Watch for rising “debtor days” (how long it takes customers to pay). A good benchmark is under 45 days, but this varies by industry.

Shrinking profit margins (both gross and net) are a critical red flag that your costs are outpacing your revenue.

Poor liquidity, measured by the Current Ratio or Quick Ratio, indicates a potential inability to cover short-term debts and day-to-day expenses.

Falling behind on compliance, especially BAS and superannuation payments, is a serious sign of underlying cash flow distress.

Many Western Australian business owners are masters of their trade—whether it’s managing a construction site, running a transport fleet, or operating a bustling cafe. However, it is easy to become so immersed in the day-to-day demands of the business that the subtle, data-driven signs of financial trouble go unnoticed. Often, by the time a problem becomes obvious, such as struggling to make payroll or pay suppliers, it has already escalated into a full-blown crisis, severely limiting options and causing immense stress.

The key to long-term financial stability and resilience is to treat a business’s finances like personal health: with regular, proactive check-ups. By monitoring a few key numbers and trends, it is possible to spot the early warning signs of distress and take corrective action while there are still plenty of options available. This guide will walk through five critical financial indicators, what they mean for a WA business, and the practical steps that can be taken to get back on track.

Warning Sign 1: Your Debtor Days Are Creeping Up

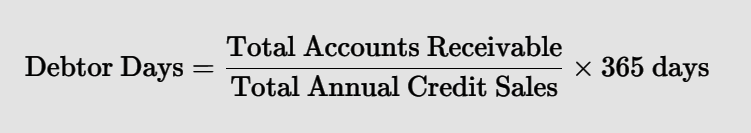

What Are "Debtor Days"?

“Debtor days,” also known as Days Sales Outstanding (DSO), is a simple but powerful metric that measures the average number of days it takes for customers to pay their invoices after a sale has been made on credit. It is a direct measure of how efficiently a business is collecting the money it is owed. The calculation is straightforward:

Why It's a Critical Metric

High or increasing debtor days are a major red flag because they mean the business’s cash is tied up in its customers’ bank accounts instead of its own. This directly strains cash flow and impacts the ability to pay suppliers, meet payroll, and cover other essential operating costs. According to a SME Growth Index report by ScotPac, late payments are a significant stressor for Australian businesses, with over 80% reporting that they have experienced them. This makes monitoring debtor days a critical activity for any business that offers credit terms.

What's a "Good" Number?

While a general benchmark for healthy debtor days is fewer than 45 days, the ideal number can vary significantly by industry. The Business Council of Australia’s Supplier Payment Code advocates for 30-day payment terms, which serves as an excellent target for many businesses. However, the most important indicator is the trend within the business itself. If a business’s average debtor days have climbed from 35 to 55 over the past six months, this is a clear warning sign that requires immediate attention, regardless of the industry benchmark.

Proactive Steps to Take

-

Review and Enforce Payment Terms:

Ensure all invoices clearly state the payment due date and any penalties for late payment. -

Systematise Collections:

Implement a consistent process for following up on overdue invoices, including automated email reminders and follow-up phone calls. -

Offer Early Payment Incentives:

Consider offering a small discount, such as 1-2%, for invoices paid ahead of the due date to encourage prompt payment. -

Consider Invoice Financing:

For businesses with significant capital tied up in receivables, invoice financing can provide immediate access to cash by allowing them to borrow against the value of their unpaid invoices.

Warning Sign 2: Your Profit Margins Are Shrinking

Gross Profit vs. Net Profit Margin

It is crucial to track both gross and net profit margins, as they tell different stories about a business’s health.

-

Gross Profit Margin:

This is the percentage of revenue remaining after deducting the direct costs associated with producing goods or delivering services, known as the Cost of Goods Sold (COGS). The formula is: Gross Profit Margin (%) = (Gross Profit / Total Revenue) x 100. It is a primary indicator of production and pricing efficiency. -

Net Profit Margin:

This is the percentage of revenue left after all business expenses—including overheads like rent, salaries, marketing, and interest—have been deducted. The formula is: Net Profit Margin (%) = (Net Income / Total Revenue) x 100. This is the ultimate measure of a business's overall profitability.

Why a Decline is a Red Flag

A shrinking Gross Profit Margin is a serious warning that input costs, such as materials and direct labour, are rising faster than the prices being charged to customers. A shrinking Net Profit Margin indicates that overheads and other operating costs are becoming unsustainable relative to the revenue being generated. Both trends erode a business’s ability to generate cash and can lead to financial distress if left unaddressed.

Checking Against ATO Benchmarks

The Australian Taxation Office (ATO) provides an invaluable resource for business owners by publishing small business benchmarks for over 100 industries. These benchmarks include key expense-to-turnover ratios, which can be used to gauge how a business’s profit margins compare to its peers. For instance, the ATO benchmark for the cost of sales in a coffee shop with a turnover under $500,000 is between 34% and 40%. If a business’s cost of sales is significantly higher, it indicates a potential issue with either supplier costs or pricing.

Proactive Steps to Take

-

Conduct a Full COGS Review:

Analyse all direct costs and renegotiate prices with suppliers or explore alternative sourcing options. -

Analyse Pricing Strategy:

Determine if prices are sufficient to cover rising costs and maintain a healthy margin. It may be necessary to implement a price increase. -

Review Overheads:

Scrutinise all operating expenses, from rent and utilities to subscriptions and marketing spend, to identify areas where costs can be safely reduced.

Revenue figures alone can be dangerously misleading. A business can achieve record-high sales and still be heading towards insolvency if its margins are collapsing. Recent economic conditions, including inflation and rising input costs, have put immense pressure on SME profitability. These pressures manifest first as shrinking profit margins, long before the business starts missing loan payments. Therefore, profit margins should be viewed as a leading indicator of financial distress, whereas the cash balance in the bank is a lagging indicator. A business owner who only watches their bank account is looking in the rearview mirror. By proactively tracking Gross and Net Profit Margins on a monthly basis and comparing them to ATO benchmarks, they can identify the “squeeze” early and make strategic decisions about pricing or cost control before it evolves into a full-blown cash flow crisis.

Your Business Financial Health Checklist

Warning Sign

Key Metric

Healthy Range

Proactive Fix

1. Slowing Customer Payments

Key Metric

Debtor Days

Healthy Range

< 45 days (or consistently stable)

Proactive Fix

Systematise invoice reminders; offer early payment discounts.

2. Shrinking Profitability

Key Metric

Gross & Net Profit Margins

Healthy Range

Stable or increasing; compare to ATO industry benchmarks.

Proactive Fix

Review supplier costs and your own pricing strategy immediately.

3. Poor Liquidity

Key Metric

Current Ratio (Current Assets / Current Liabilities)

Healthy Range

> 1.5 (ideally > 2)

Proactive Fix

Create a detailed cash flow forecast; consider a line of credit for a buffer.

4. High Debt Levels

Key Metric

Debt-to-Equity Ratio (Total Liabilities / Equity)

Healthy Range

Varies by industry, but a consistently rising trend is a red flag.

Proactive Fix

Consolidate high-interest debts; review loan structures with a broker.

5. Falling Behind on Compliance

Key Metric

ATO Payment Status

Healthy Range

All BAS, tax, and superannuation payments are lodged and paid on time.

Proactive Fix

Contact the ATO's support unit immediately to discuss a payment plan.

Warning Sign 3: You're Facing a Liquidity Squeeze

What is Liquidity?

Liquidity refers to a business’s ability to meet its short-term financial obligations—essentially, having enough cash on hand (or assets that can be quickly converted to cash) to pay bills as they fall due. Poor cash flow, as identified in the first warning sign, is a direct symptom of a liquidity problem. A business can be profitable on paper but fail due to a lack of liquidity to cover its day-to-day operating expenses.

Key Ratios to Watch

Two key accounting ratios provide a clear snapshot of a business’s liquidity:

-

Current Ratio:

This is calculated by dividing current assets (cash, accounts receivable, inventory) by current liabilities (accounts payable, short-term loans). A ratio below 1 indicates that the business does not have enough liquid assets to cover its debts due within the next 12 months. A healthy ratio is often considered to be above 1.5 or 2:1. -

Quick Ratio (or Acid-Test Ratio):

This is a more conservative measure calculated as Quick Ratio = (Current Assets - Inventory) / Current Liabilities. It excludes inventory, which can sometimes be difficult to sell quickly. A quick ratio below 1 is a significant warning sign of potential cash flow problems.

Proactive Steps to Take

A credit report shows what happened, but not why. It is crucial to prepare a brief, honest, and factual explanation for any significant negative listings. Was a default caused by a one-off event, such as a major client failing to pay, a medical emergency, or a specific industry downturn?. Providing this context allows a human credit assessor at a specialist lender to look beyond the black-and-white data and make a more holistic assessment of the risk.

-

Prepare a Cash Flow Forecast:

Develop and regularly update a detailed 13-week cash flow forecast. This forward-looking tool is essential for anticipating potential cash shortfalls and managing liquidity proactively. -

Liquidate Unproductive Assets:

Sell off old or excess stock, even at a discount, to convert it into much-needed cash. -

Establish a Buffer:

Secure a business line of credit or overdraft facility. This provides a safety net of accessible funds to cover expenses during quieter trading periods or when waiting on large customer payments.

Frequently Asked Questions

How often should I do a financial health check?

At a minimum, you should review your key financial statements (P&L, Balance Sheet, Cash Flow) monthly and check your key ratios quarterly to spot trends early.

What is a good profit margin?

This is highly industry-specific. The best approach is to use the ATO’s small business benchmarks, which are available on their website and are categorised by industry and turnover, to compare your performance against your peers.

My sales are high but my cash flow is poor. Why?

This is a classic sign of high debtor days. Your customers are taking too long to pay you. The profit exists on paper in your accounts receivable, but it has not yet been converted to cash in your bank account.

What is the difference between the Current Ratio and the Quick Ratio?

The Quick Ratio is a stricter test of a company’s liquidity because it excludes inventory from current assets. This is because inventory cannot always be converted to cash quickly in an emergency.

Is it bad to have business debt?

No, debt is a normal and essential tool for funding growth. The warning sign is an over-reliance on debt, where your Debt-to-Equity ratio is excessively high for your industry or is increasing rapidly over time.

I've missed a BAS payment. What should I do?

Contact the ATO’s small business support unit immediately. They are far more likely to be helpful and arrange a manageable payment plan if you are proactive and transparent about your situation.

Where can I find industry benchmarks for my business?

The ATO provides free small business benchmarks on their website, which are searchable by industry and turnover bracket. Commercial providers like IBISWorld also offer detailed industry financial ratio reports.

Can a finance broker help me with a financial health check?

Yes, a good commercial finance broker will conduct a thorough review of your financial position as part of any loan application process. They can help you understand your key ratios and advise on how to restructure your debt to improve your business’s overall financial health.

My customer complaints have increased. Is this a financial warning sign?

Yes, it can be an indirect but important warning sign. An increase in complaints may indicate that you are cutting corners on product quality or customer service due to financial pressure, which will ultimately harm your reputation and lead to a drop in sales.

What is a "per capita recession" and how does it affect my business?

A per capita recession occurs when the country’s overall economic growth (GDP) is slower than its population growth, meaning economic output per person is shrinking. It is a key indicator of a slowing economy and often leads to reduced consumer discretionary spending, which is a significant risk for many SMEs.

My accountant says my records are messy. Is this a big deal?

Yes, it is a very big deal. Poor record-keeping is a major warning sign in itself. It means you do not have a clear and accurate view of your financial position, making it impossible to calculate key ratios or spot other warning signs before they become critical problems.

Warning Sign 4 & 5: High Debt & Compliance Issues

Warning Sign 4: An Over-reliance on Debt

While debt is a normal and often necessary tool for funding business growth, an over-reliance on it can be a sign of financial distress. The Debt-to-Equity Ratio, calculated by dividing total liabilities by shareholder’s equity, measures how much the business depends on borrowing compared to the owner’s own funds. A high or rapidly increasing ratio can indicate that the business is not generating enough profit to fund its own growth and is becoming progressively riskier for both the owners and potential lenders.

A proactive step to address this is to review the current debt structure. It may be possible to consolidate multiple high-interest debts into a single loan with better terms or a lower overall repayment. This is a primary reason to strategically consider options like a commercial balloon refinance well before the final payment is due, allowing for a structured and manageable transition to new financing.

Warning Sign 5: Falling Behind with the ATO

This is one of the most serious red flags for any business. Falling behind on lodging or paying Business Activity Statements (BAS), Pay As You Go (PAYG) withholding for employees, or superannuation contributions is a critical sign of severe cash flow distress. It effectively means the business is using funds held in trust for the government and its employees as working capital, a practice that is both unsustainable and illegal. Data from the ATO shows that collective tax debt is a widespread issue, having increased significantly in the years following the pandemic.

The most important proactive step is to engage with the authorities early. The ATO’s small business support unit is often willing to work with businesses that are transparent about their situation, potentially offering payment plans or deferrals. Ignoring the problem will only lead to more severe consequences.

If you've identified some warning signs in your business and want to review your current loan structures, contact Varlo Finance for a confidential financial health check.

Staying on top of your business’s financial health is not about being an accountant; it is about being a proactive and strategic owner. By regularly monitoring a few key indicators—how quickly you are getting paid, the profitability of your sales, your ability to cover short-term bills, and your compliance with obligations—you can shift from reacting to crises to strategically managing your business’s future.

Do not wait for the warning lights to start flashing red on your financial dashboard. Make these five checks a regular part of your business routine. If you spot a negative trend developing, act early. Speaking to a trusted advisor like your accountant or a specialist finance broker can provide the expert guidance needed to analyse your current loan structures, implement strategies to improve cash flow, and ensure your business is built on a solid and resilient financial foundation.